How Clean Energy Could Prepare for an AI Bubble

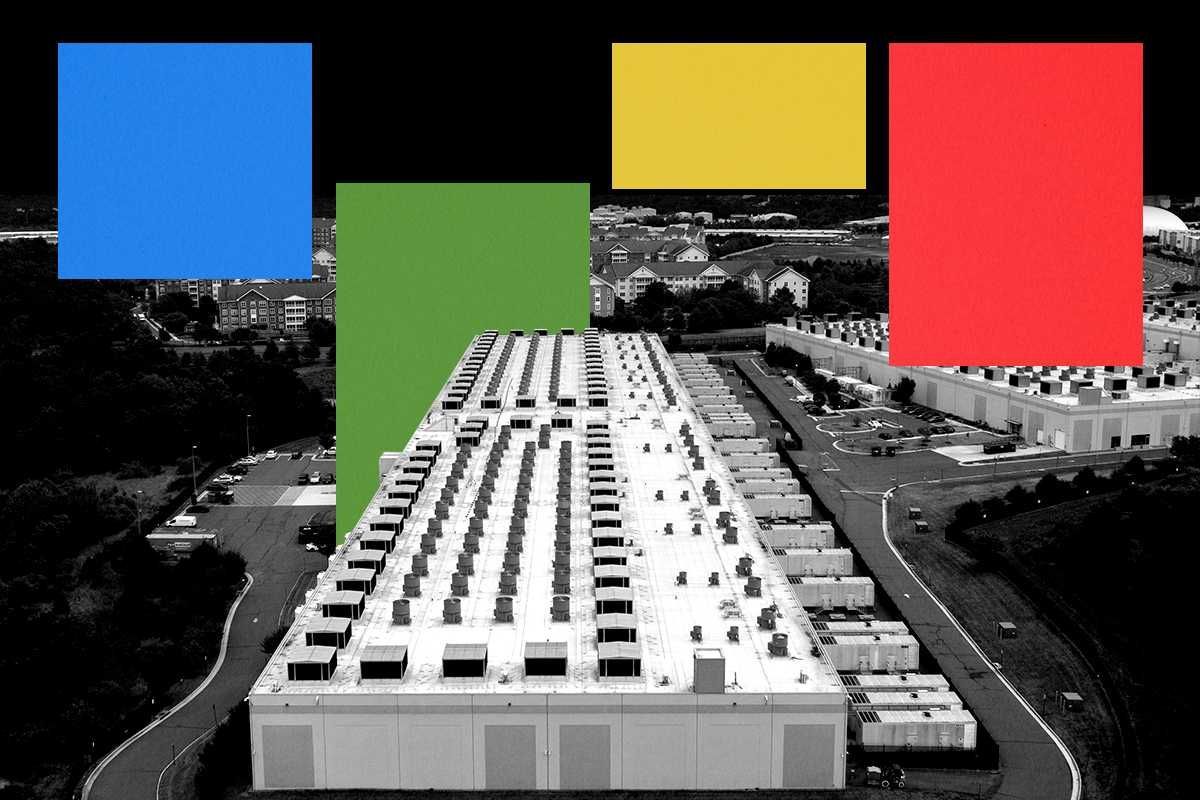

The boom in artificial intelligence has become entangled with the clean energy industry over the past 18 months. Tech companies are willing to pay a lot for electricity — especially reliable zero-carbon electricity — and utilities and energy companies have been scrambling to keep up.

But is that boom more like a bubble? And if so, what does that mean for the long-term viability of AI companies and data center developers, and for the long-term health of decarbonization?

On this week’s Shift Key, we’re talking to Advait Arun, a senior associate for capital markets at the Center for Public Enterprise, about his new report on the market dynamics at play in the data center buildout. What kind of bets are these AI companies making? How likely are they to pay off? And if they don’t, who stands to lose big? Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap, and Jesse Jenkins, a professor of energy systems engineering at Princeton University.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from our conversation:

Robinson Meyer: Advait, you’ve done a — we’ve done a great job of kind of dancing around maybe the biggest question of the report — and I would say you do a very good job of playing coy about it in the report, where the report’s titled “Bubble or Nothing.” You actually don’t come out and say whether you think this is a bubble or not.

And of course, it’s kind of a weird bubble, too, because there hasn’t been a moment where these leaps in equity valuations for the hyperscalers has happened where people haven’t been like, Boy, it looks kind of bubbly. And if you remember back to the 20-teens too, people were worried about a tech bubble then, too. And it turned out that it wasn’t a tech bubble, it was just a rapidly growing and healthy part of the economy. And so what I wanted to ask you, Advait, was, number one, did you walk away from this and from your conversations with investors and creditors, policymakers, thinking it was a bubble? And number two, is this unusual that we have a bubble and we can’t stop talking about how bubbly it looks? Or is this a new type of bubble where there’s a bubble happening and we all know it’s a bubble?

Advait Arun: Ooh. I will not personally say whether or not I think this is a bubble. I do think, though, that the fact that so much of our attention is centralized around it, it testifies to a new way of the real media’s relationship with the economy — and not even the media just in general, but the fact that the federal government is interested in this being the next industry of the future. The fact that I think we haven’t had too much else to talk about in economic news due to the dominance of the hyperscalers and Mag Seven in the market, the fact that they’re the collateral for improvements in the energy system, and even some people are blaming them for the affordability crisis. I think it’s very easy to get into a headspace where we’re all paying rapt attention to the day-to-day stock movements of these companies. I don’t know what it was like, necessarily, to be following the news and the dot-com bubble, but I do certainly think that the amount that we’ve all been talking about it at the same time is very striking to me.

I think it’s important, as well, to recognize that bubbles have psychological motivations, more so than just pure economic motivations. Of course, from the perspective of a policymaker and someone who’s done credit analysis for stuff, I obviously look at these firms and look at their lack of revenue and think, This is dangerous. This could be getting over their skis. But a lot of companies have gone through this point and made it out. That’s not to say that these companies will or won’t, but the fact that so much of the market moves in response to the leading tech companies, there’s a degree of asset centrality and crowding, and extremely high relative values relative to historical values. It makes me think that there’s something to watch out for, anchored by the fact that a lot of the people leading this investment boom, whether it’s the federal government seeking to promote it or whether it’s the leaders of these companies, the CEOs envisioning some kind of vastly different future for the economy. There’s a psychology to it — I think Keynes would call it ‘animal spirits’ — that’s pushing this investment boom the way that it’s going.

Mentioned:

Advait’s report: Bubble or Nothing: Data Center Project Finance

Previously on Shift Key: A Skeptic’s Take on AI and Energy Growth

Jesse’s upshift; Rob’s downshift.

This episode of Shift Key is sponsored by …

Hydrostor is building the future of energy with Advanced Compressed Air Energy Storage. Delivering clean, reliable power with 500-megawatt facilities sited on 100 acres, Hydrostor’s energy storage projects are transforming the grid and creating thousands of American jobs. Learn more at hydrostor.ca.

Uplight is a clean energy technology company that helps energy providers unlock grid capacity by activating energy customers and their connected devices to generate, shift, and save energy. The Uplight Demand Stack — which integrates energy efficiency, electrification, rates, and flexibility programs — improves grid resilience, reduces costs, and accelerates decarbonization for energy providers and their customers. Learn more at uplight.com/heatmap.

Music for Shift Key is by Adam Kromelow.